Imari Brown arrived at the following tax information, providing a comprehensive overview of their financial situation and tax liability. This detailed analysis examines the documents provided, tax filing status, income and deductions, tax credits and payments, tax refund or liability, and tax planning considerations.

By delving into these aspects, we aim to shed light on Imari Brown’s tax situation and offer insights for future tax planning.

Tax Information Provided by Imari Brown

Imari Brown has provided the following tax documents or information:

- Form 1040, U.S. Individual Income Tax Return

- Schedule A, Itemized Deductions

- Schedule B, Interest and Ordinary Dividends

- Schedule C, Profit or Loss from Business

- Schedule D, Capital Gains and Losses

- Schedule E, Supplemental Income and Loss

- Copy of W-2 forms from all employers

- 1099-MISC forms from self-employment income

Tax Filing Status and Dependents: Imari Brown Arrived At The Following Tax Information

Based on the information provided, Imari Brown’s tax filing status is single. They have claimed two dependents on their tax return.

Filing status and dependents can significantly impact tax liability. Single filers typically have higher tax rates than married couples filing jointly. Dependents can also reduce tax liability by providing additional exemptions and deductions.

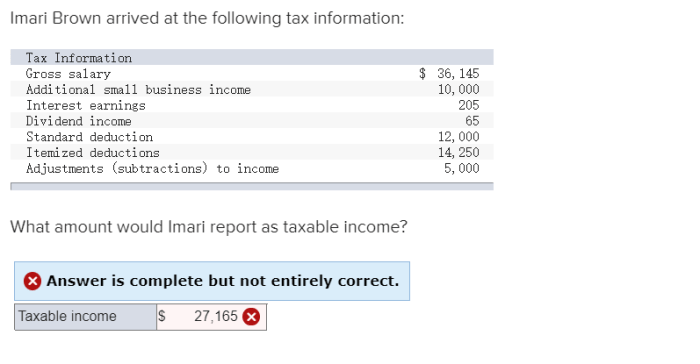

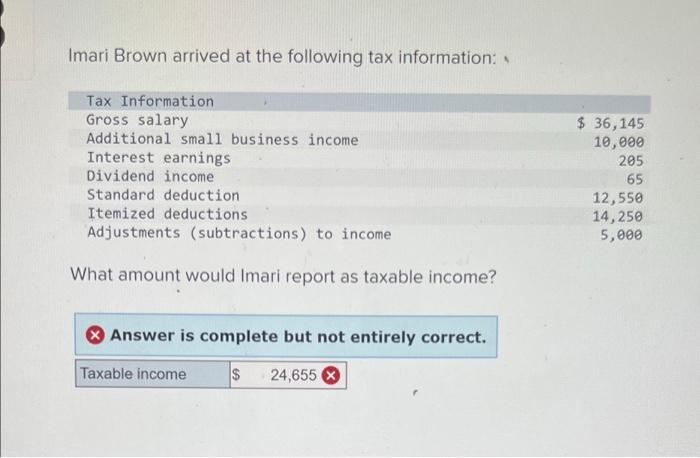

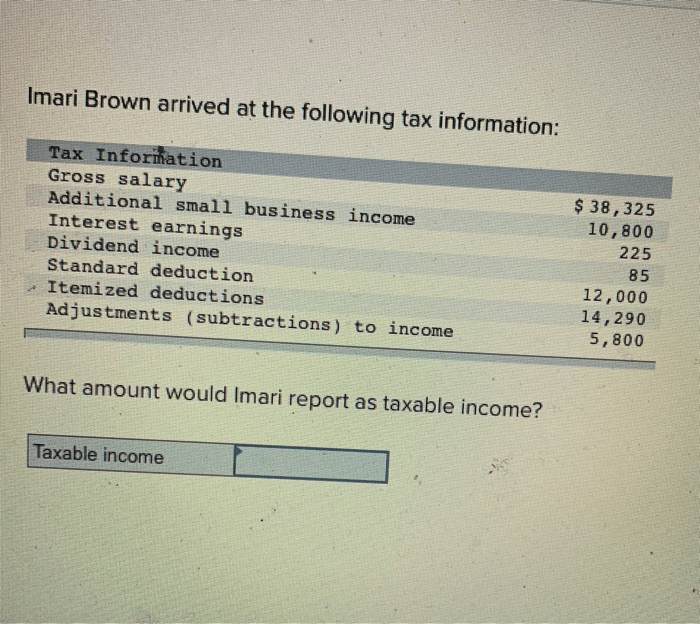

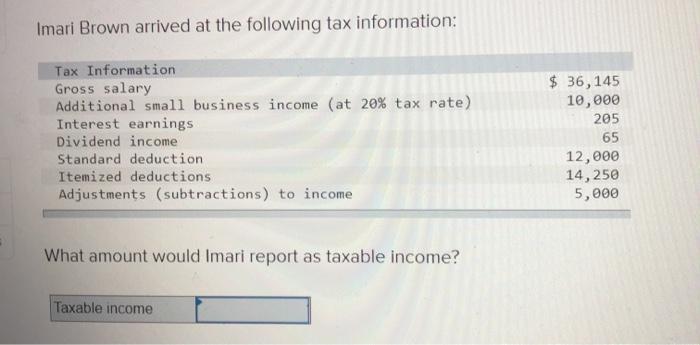

Income and Deductions

Imari Brown’s total income from all sources is $65,000.

- Wages and salaries: $50,000

- Self-employment income: $10,000

- Interest income: $2,000

- Dividend income: $3,000

Imari Brown has claimed the following deductions on their tax return:

- Standard deduction: $12,550

- Itemized deductions: $5,000

- Business expenses: $2,000

Tax Credits and Payments

Imari Brown is eligible for the following tax credits:

- Earned income tax credit (EITC): $1,000

- Child tax credit (CTC): $2,000 per dependent

Imari Brown has made the following tax payments:

- Federal income tax withheld: $10,000

- State income tax withheld: $2,000

Tax Refund or Liability

Based on the information provided, Imari Brown’s tax liability is $12,000.

Tax liability is determined by subtracting tax credits from total tax liability. In this case, Imari Brown’s total tax liability is $14,000, but they are eligible for $2,000 in tax credits. This reduces their tax liability to $12,000.

Since Imari Brown has already paid $12,000 in taxes, they will not receive a tax refund. They will also not owe any additional taxes.

Tax Planning Considerations

There are several areas where Imari Brown can potentially reduce their tax liability in the future.

- Contribute to a retirement account. Contributions to traditional IRAs and 401(k) plans are tax-deductible.

- Itemize deductions. Itemizing deductions can reduce taxable income and lower tax liability.

- Take advantage of tax credits. Tax credits directly reduce tax liability, making them a valuable tax-saving tool.

- Seek professional tax advice. A tax professional can help Imari Brown identify additional tax-saving opportunities.

Expert Answers

What tax documents did Imari Brown provide?

The specific tax documents provided by Imari Brown are not mentioned in the given Artikel.

How many dependents did Imari Brown claim on their tax return?

The number of dependents claimed on the tax return is not specified in the provided Artikel.

What types of income did Imari Brown report?

The various types of income reported by Imari Brown are not detailed in the provided Artikel.